How to Raise Your Credit Score Fast: 7 Proven Strategies

Discover 7 proven strategies to raise my credit score quickly. Our actionable guide shows how to dispute errors, lower utilization, and build positive credit history fast.

Have you been rejected for a loan or offered sky-high interest rates because of your credit score? You’re not alone. James, a client of mine, was devastated when his mortgage application was denied due to a 580 credit score. But just 90 days later, he qualified with a score of 640 after implementing the strategies I’m about to share. If you need to raise your credit score quickly for an upcoming loan application or to secure better rates, this actionable guide will show you exactly what steps to take—and how fast you can expect results.

Understanding Credit Score Basics

Before diving into improvement strategies, let’s clarify what makes up your credit score. Most lenders use either FICO or VantageScore models, with scores ranging from 300-850. Here’s what’s considered good:

| Score Range | Rating | What It Means |

| 300-579 | Poor | Difficult to qualify for most credit products |

| 580-669 | Fair | Below average; may qualify with higher rates |

| 670-739 | Good | Near or slightly above average |

| 740-799 | Very Good | Above average; qualifies for better rates |

| 800-850 | Exceptional | Well above average; gets best available rates |

Your credit score is calculated based on five key factors, with some having more impact than others:

Major Factors (65% of score)

- Payment History (35%): Whether you pay bills on time

- Credit Utilization (30%): How much of your available credit you’re using

Minor Factors (35% of score)

- Length of Credit History (15%): How long you’ve been using credit

- Credit Mix (10%): Types of credit accounts you have

- New Credit (10%): Recent applications and new accounts

Ready to see where you stand?

Check your credit reports from all three bureaus for free.

Strategy 1: Dispute Credit Report Errors

Credit report errors are surprisingly common and can significantly drag down your score. Sarah, a teacher from Ohio, found a collections account that wasn’t hers and saw her score jump 58 points within 6 weeks after having it removed.

How to Dispute Errors Effectively:

- Request your free credit reports from AnnualCreditReport.com

- Review disputes online with each credit bureau where the error appears

- Include up after 30 days if you haven’t received a response

FTC Dispute Template: “I am writing to dispute the following information in my credit report. The item I am disputing is [describe item]. This item is [inaccurate/incomplete] because [explain why]. I request that the item be removed [or corrected] to reflect accurate information.”

Score Impact: Potentially high (20-100+ points)

Timeframe: 30-45 days for bureaus to investigate and respond

Strategy 2: Lower Your Credit Utilization Ratio

Your credit utilization ratio—the percentage of available credit you’re using—has a major impact on your score. Keeping this ratio below 30% is good, but below 10% is ideal for the biggest score boost.

Quick Math Example:

| Credit Card | Credit Limit | Current Balance | Utilization Ratio | Target Balance (30%) | Target Balance (10%) |

| Card A | $5,000 | $3,500 | 70% | $1,500 | $500 |

| Card B | $2,500 | $1,000 | 40% | $750 | $250 |

| Total | $7,500 | $4,500 | 60% | $2,250 | $750 |

Three Ways to Lower Utilization Fast:

- Pay down balances before statement closing dates (when balances are reported)

- Request credit limit increases on existing accounts

- Make multiple payments throughout the month to keep balances low

Real Example: Michael paid down his credit card balances from 75% to 25% utilization and saw a 42-point score increase in just one billing cycle.

Score Impact: High (20-45+ points)

Timeframe: As soon as new lower balances are reported (typically next billing cycle)

Need help tracking your utilization?

Many free credit monitoring services can alert you when your utilization gets too high.

Strategy 3: Set Up Automatic Payments

Payment history accounts for 35% of your credit score, making it the single most important factor. Even one missed payment can drop your score by 80+ points and stay on your report for seven years.

How to Ensure 100% On-Time Payment History:

- Set up automatic payments for at least the minimum amount due

- Schedule payments 2-3 days before the due date to allow for processing

- Set calendar reminders as a backup

- Consider using a bill payment app that sends alerts

Pro Tip: If you accidentally miss a payment by a few days, call your creditor immediately and ask for a goodwill adjustment. Many will waive the late fee and agree not to report it to the bureaus if you have a good history with them.

Score Impact: Prevents negative impacts (protects from 80+ point drops)

Timeframe: Ongoing protection; positive payment history builds over time

Strategy 4: Become an Authorized User

Being added as an authorized user on someone else’s credit card account with a positive history can be one of the fastest ways to boost your score, especially if you have limited credit history.

How to Use the Authorized User Strategy:

- Ask a trusted family member or close friend with excellent credit history

- Ensure their account has:

- Long history (ideally 2+ years)

- Perfect payment record

- Low utilization ratio

- Reports to all three credit bureaus

- You don’t need physical access to the card—just being added to the account is enough

- Confirm with the credit card issuer that they report authorized users to credit bureaus

Important: This strategy works because the primary cardholder’s account history gets added to your credit report. However, if they miss payments or max out the card, your score will suffer too.

Real Example: Jennifer was added as an authorized user on her mother’s 12-year-old credit card with perfect payment history. Her score jumped 87 points in just 45 days.

Score Impact: Potentially very high (20-100+ points)

Timeframe: As soon as the account appears on your credit report (typically 30-60 days)

Strategy 5: Use Secured Credit Cards Strategically

If you have limited or damaged credit, a secured credit card can be an excellent tool for rebuilding. Unlike regular credit cards, secured cards require a security deposit that typically becomes your credit limit.

How to Use Secured Cards to Boost Your Score:

- Choose a card that reports to all three major credit bureaus

- Make a deposit of at least $200-$500 (higher if possible for better utilization)

- Use the card for small, regular purchases (10-20% of your limit)

- Pay the balance in full each month before the due date

- After 6-12 months of responsible use, many issuers will upgrade you to an unsecured card

Best Practices:

- Keep utilization under 10%

- Set up automatic payments

- Don’t apply for multiple cards at once

What to Avoid:

- Missing payments

- Maxing out the card

- Cards with high annual fees

Score Impact: Moderate to high over time (30-60+ points)

Timeframe: 3-6 months of consistent use

Ready to rebuild with a secured card?

Compare options that match your credit profile.

Strategy 6: Negotiate “Pay for Delete” Agreements

If you have collection accounts dragging down your score, you may be able to negotiate their removal in exchange for payment—a strategy known as “pay for delete.”

Step-by-Step Negotiation Process:

- Get the collection agency’s information from your credit report

- Contact them and offer to pay the debt in exchange for complete removal from your credit reports

- Get any agreement in writing before making payment

- Use certified mail with return receipt or email confirmation

- After payment, verify the item is removed from all three credit reports

Sample Script: “I’m calling about account #[number]. I’m prepared to pay [amount] to settle this account if you agree to completely remove it from all credit reports, not just mark it as ‘paid.’ Can you agree to that?”

Important Note: Some newer credit scoring models (FICO 9, VantageScore 3.0 and 4.0) ignore paid collections, so even without deletion, paying off collections can help your score with lenders using these models.

Score Impact: Potentially high (20-110+ points)

Timeframe: 30-60 days after deletion is processed

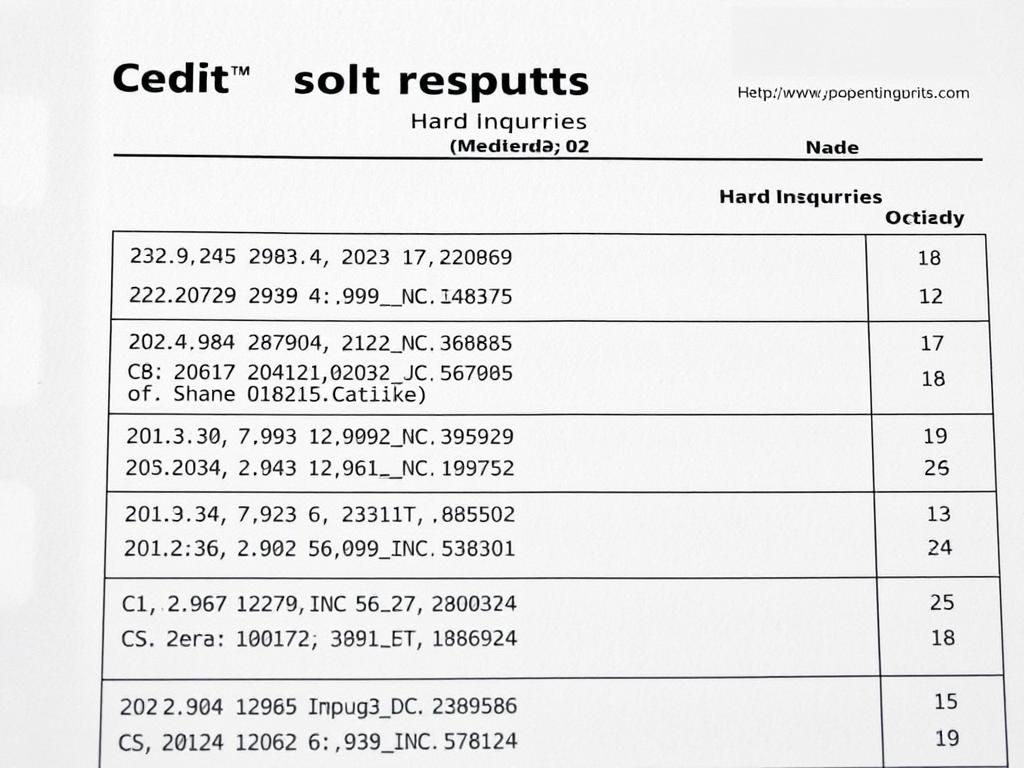

Strategy 7: Limit Hard Inquiries

Each time you apply for credit, a “hard inquiry” is placed on your report, which can temporarily lower your score. Managing these inquiries strategically is important when trying to raise your credit score quickly.

Hard vs. Soft Inquiries: What’s the Difference?

| Hard Inquiries | Soft Inquiries |

| Appear when you apply for new credit | When you check your own credit |

| Can lower your score by 5-10 points | Have zero impact on your credit score |

| Stay on your report for 2 years | May not appear on your consumer report |

| Examples: Credit card, loan, mortgage applications | Examples: Pre-approvals, background checks |

Smart Inquiry Management:

- Rate shop for specific loans (mortgages, auto, student) within a 14-45 day window—these will count as a single inquiry

- Check if you pre-qualify before applying (many lenders offer soft-pull pre-qualification)

- Space out credit card applications by at least 3-6 months

- Focus on improving other aspects of your credit before applying for new accounts

Score Impact: Prevents negative impacts (protects from 5-10 point drops per inquiry)

Timeframe: Immediate protection; hard inquiries have less impact after 12 months

Credit Score Myths vs. Facts

FACTS

- Paying off credit card balances can raise your score quickly

- You can check your own credit without hurting your score

- Having some credit cards can help your score if managed responsibly

- Removing inaccurate negative information can significantly boost your score

- Credit scores can recover from past mistakes over time

MYTHS

- Closing old credit cards will help your score

- You need to carry a balance to build credit

- Checking your credit lowers your score

- All credit repair companies can remove accurate negative items

- Income directly affects your credit score

Realistic Timeline for Credit Score Improvement

| Timeframe | Potential Strategies | Possible Improvement |

| 30 Days | Pay down credit card balances, become authorized user | 20-45 points |

| 60 Days | Dispute errors, negotiate collections | Additional 10-30 points |

| 90 Days | Consistent on-time payments, secured card reporting | Additional 10-20 points |

| 6+ Months | Continued positive payment history, decreased utilization | Additional 20-50+ points |

Take Action Today to Raise Your Credit Score

Remember that while some strategies can boost your score relatively quickly, sustainable credit improvement takes time and consistent good habits. Start with the highest-impact actions first: disputing errors, paying down balances, and becoming an authorized user can often yield the fastest results.

As Mark, a client who raised his score by 96 points in three months, told me: “The hardest part was just getting started. Once I had a plan and could see the progress, it became much easier to stay motivated.”

Ready to start your credit improvement journey?

The first step is knowing exactly where you stand. Get your free credit reports today.

Remember, the path to better credit starts with a single step. The strategies in this guide have helped thousands of people just like you transform their credit profiles and unlock better financial opportunities. Your improved credit score is waiting—you just need to take action.