Your Friendly Guide to Credit Repair: Simple Steps to Boost Your Score

Discover practical credit repair strategies to improve your financial health. Learn how to check reports, dispute errors, and boost your credit score with our simple step-by-step guide.

Have you ever been turned down for a loan or shocked by sky-high interest rates? A less-than-stellar credit score might be the culprit. The good news is that credit repair isn’t as complicated as it sounds. Whether you’re trying to qualify for a mortgage, secure a car loan, or simply improve your financial health, this guide will walk you through the practical steps to repair your credit and get back on track.

What Is Credit Repair?

Credit repair is the process of fixing poor credit that may have deteriorated for a variety of reasons. Repairing credit involves addressing negative information on your credit report to improve your credit score. This can include disputing errors with credit bureaus, negotiating with creditors, and building positive credit history moving forward.

Your credit report contains information about your payment history, the amount of debt you have, and whether you’ve filed for bankruptcy, among other details. Credit bureaus collect this information and use it to create your credit score, which lenders check when deciding whether to approve you for loans and credit cards.

Why Credit Repair Matters

A good credit score opens doors to better financial opportunities. It can help you:

- Qualify for lower interest rates on loans and credit cards

- Get approved for rental applications

- Avoid security deposits on utilities

- Pay less for insurance in many states

- Improve your chances of employment in certain fields

DIY Credit Repair Steps

The good news is that you can take several steps to repair your credit on your own. Here’s how to get started:

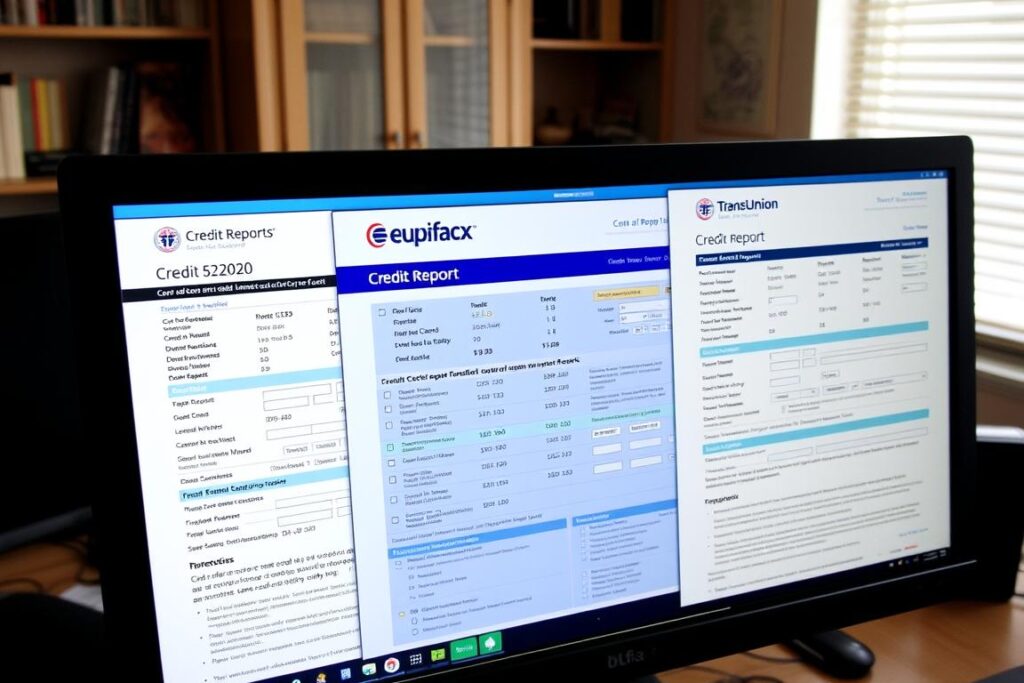

1. Get Your Free Credit Reports

Your first step is to know exactly what you’re dealing with. You’re entitled to one free credit report every 12 months from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Visit AnnualCreditReport.com to request yours.

2. Review Your Reports for Errors

Once you have your reports, carefully review them for any inaccuracies. Look for accounts you don’t recognize, incorrect payment statuses, or outdated negative information. Common errors include:

- Accounts belonging to someone with a similar name

- Closed accounts reported as open

- Incorrect account balances or credit limits

- Same debt listed multiple times

- Outdated information that should have aged off your report

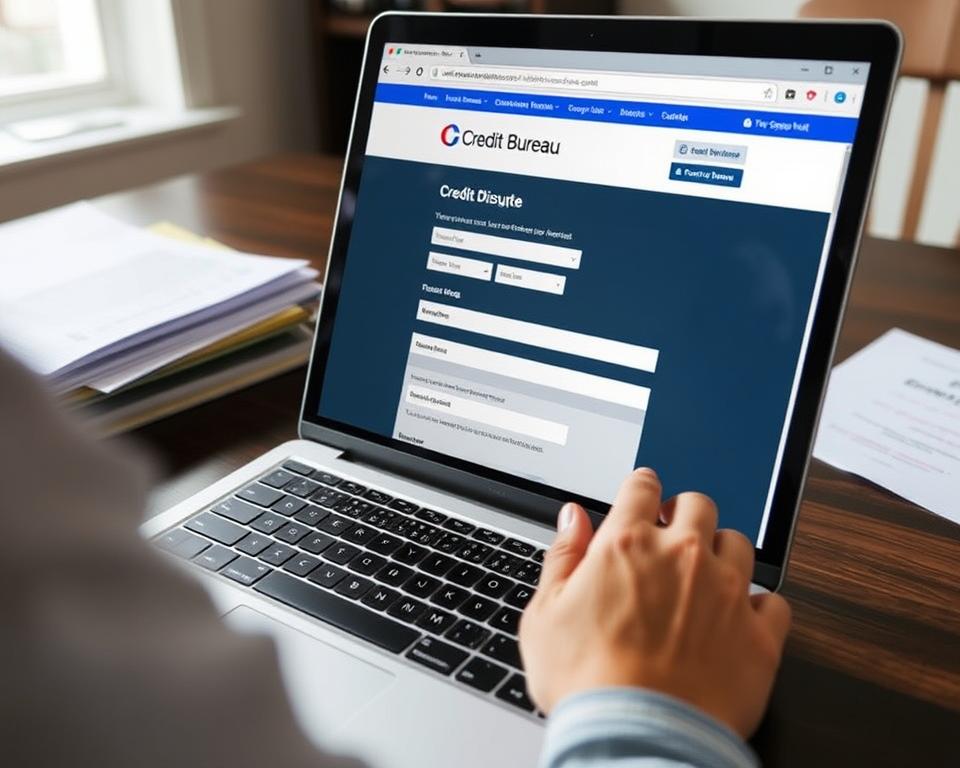

3. Dispute Errors with Credit Bureaus

If you find errors, you have the right to dispute them. You can file disputes online, by mail, or by phone directly with each credit bureau. Include copies (not originals) of documents that support your position, and keep records of everything you submit.

4. Pay Down Existing Debt

Your credit utilization ratio—how much of your available credit you’re using—significantly impacts your credit score. Aim to keep this ratio below 30%. Focus on paying down credit card balances, starting with high-interest cards first.

5. Set Up Payment Reminders

Payment history accounts for about 35% of your credit score. Set up automatic payments or calendar reminders to ensure you never miss a due date. Even one late payment can significantly damage your credit score.

When to Consider Professional Credit Repair Help

While you can handle credit repair yourself, there are situations where professional help might be beneficial:

Consider Professional Help If:

- You have multiple errors across different credit reports

- Your reports contain complex issues like identity theft

- You don’t have time to manage the dispute process

- You’ve tried disputing errors yourself without success

- You’re unsure how to navigate the credit repair process

Need Expert Help With Your Credit Repair?

Professional credit repair services can help identify errors, handle disputes, and provide personalized strategies to improve your credit score faster than you might on your own.

Avoiding Credit Repair Scams

While legitimate credit repair services exist, the industry has its share of scams. Here’s how to protect yourself:

Warning Signs of Credit Repair Scams

- They demand payment upfront before providing any services

- They promise to remove all negative information, even if it’s accurate

- They suggest creating a “new credit identity” or using an EIN instead of your SSN

- They don’t explain your legal rights or provide a written contract

- They advise you not to contact credit bureaus directly

Remember: Under the Credit Repair Organizations Act (CROA), credit repair companies cannot legally charge you before they’ve performed their services. They must also provide a written contract and allow you to cancel within three business days without charge.

Building Positive Credit Moving Forward

Credit repair isn’t just about fixing past mistakes—it’s also about building positive credit for the future:

Quick Credit-Building Strategies

- Apply for a secured credit card if you can’t qualify for traditional cards

- Become an authorized user on someone else’s well-managed account

- Consider a credit-builder loan from a credit union

- Keep old accounts open to maintain a longer credit history

- Apply for new credit only when necessary to avoid hard inquiries

The Time Factor in Credit Repair

Credit repair takes time. Most negative information stays on your credit report for seven years, while bankruptcies can remain for up to ten years. However, the impact of negative items diminishes over time, especially when you add positive information to your credit history.

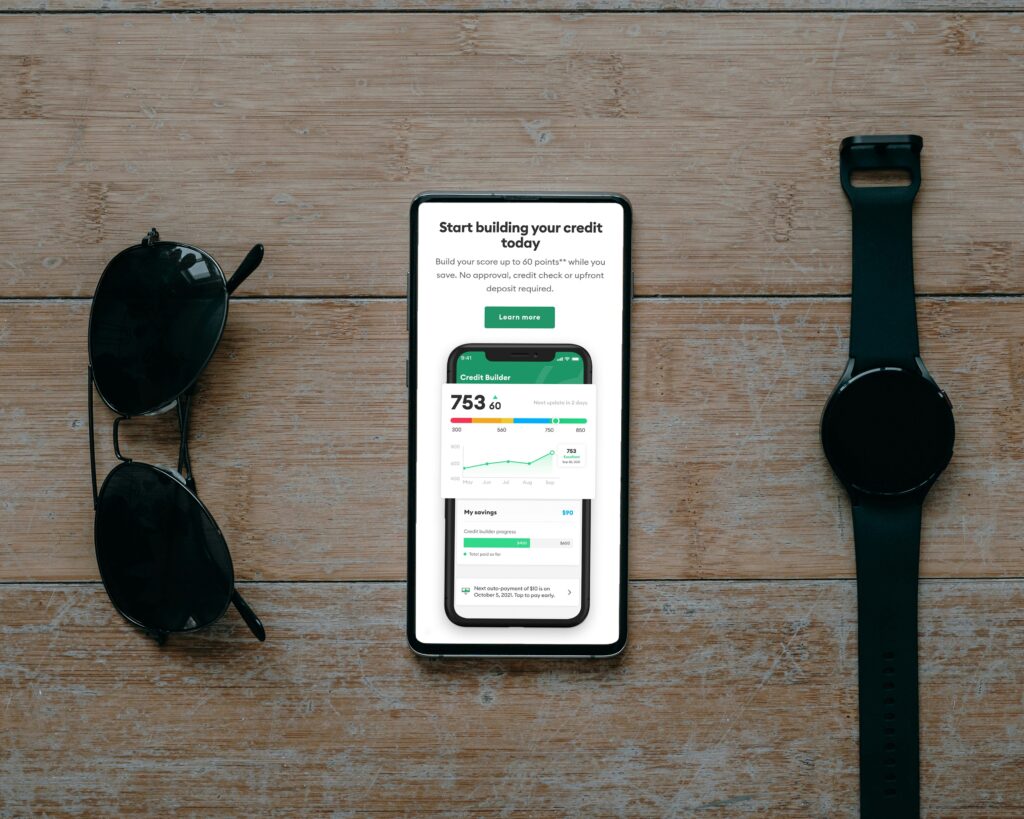

Monitoring Your Credit Repair Progress

As you work on repairing your credit, it’s important to track your progress:

Tools for Credit Monitoring

Several free and paid services can help you monitor your credit:

- Credit Karma and Credit Sesame offer free credit score updates and monitoring

- Many credit card companies provide free FICO score access

- AnnualCreditReport.com for your official reports

- Consider identity theft protection if your credit issues stemmed from fraud

Check your credit reports regularly to ensure that disputed items have been removed and no new errors have appeared. Many experts recommend checking your credit report at least once every four months by rotating between the three bureaus’ free annual reports.

Your Path to Better Credit Starts Today

Credit repair is a journey that requires patience and persistence. By understanding how credit works, addressing errors, paying down debt, and building positive credit habits, you can gradually improve your credit score and open doors to better financial opportunities.

Remember that legitimate credit repair takes time—there are no overnight fixes. Focus on the steps you can take today while developing healthy financial habits that will serve you well into the future.

Ready to Fast-Track Your Credit Repair?

While DIY methods work, professional credit repair services can often achieve faster results by leveraging their expertise and relationships with credit bureaus. Take the next step toward financial freedom today.