Credit Card Debt Solutions: Simple Ways to Control

Discover effective credit card debt solutions to regain financial control. Learn simple strategies to manage debt, improve your credit, and secure a stable financial future.

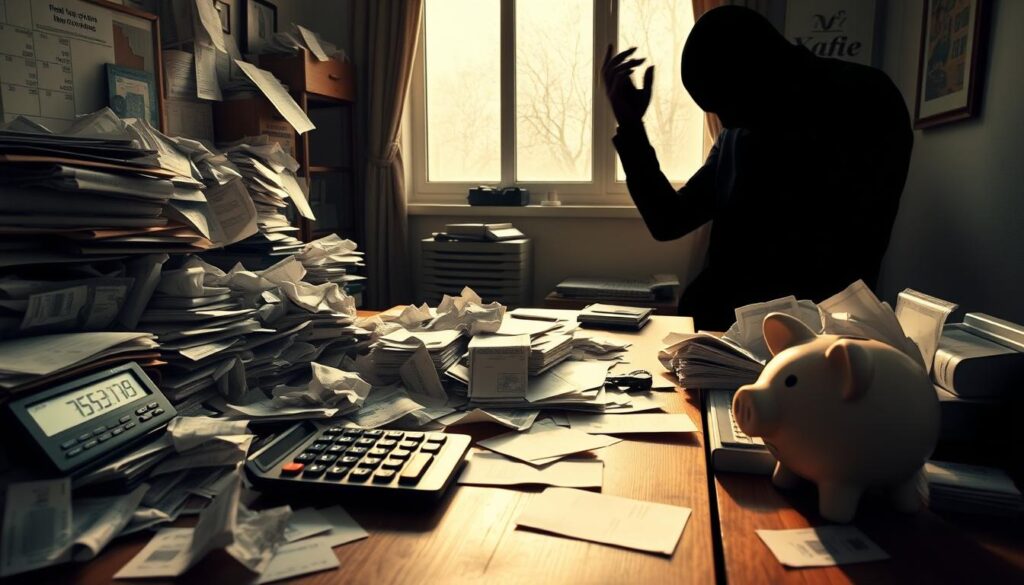

Are you feeling overwhelmed by credit card debt? You’re not alone. Millions of Americans face high balances, interest rates, and endless minimum payments. But there are simple ways to take back control of your finances. This guide will show you how to beat credit card debt and secure a stable future.

Key Takeaways

- Discover practical ways to manage credit card debt and improve your financial well-being.

- Learn how to create a customized debt repayment plan for your budget and goals.

- Explore alternative options like balance transfers, debt consolidation loans, and credit counseling.

- Understand the pros and cons of debt settlement and bankruptcy as a last resort.

- Develop budgeting and expense-tracking skills to prevent future credit card debt.

Understanding the Cycle of Credit Card Debt

Credit card debt can quickly become a big problem. It starts with the temptation of easy credit. Then, compounding interest and minimum payments make it hard to get out.

The Temptation of Easy Credit

Credit cards make buying things easy. But, the instant joy can lead to trouble. People might spend too much, thinking they can pay later.

This easy credit temptation can cause lousy spending habits. It makes people feel like they’re financially secure, but they’re not.

Compounding Interest and Minimum Payments

As you use your credit card, interest adds up fast. Paying just the minimum doesn’t help much. It lets interest keep growing your debt.

This creates a cycle that’s hard to break. It feels like you’re stuck forever, trying to pay off your debt.

Knowing how credit card debt works is key to getting out. Recognize the dangers of easy credit and the harm of compounding interest and minimum payments. Then, you can start to retake control of your money.

| Factor | Description |

|---|---|

| Easy Credit Temptation | The convenience and allure of instant gratification offered by credit cards can lead to impulsive spending and a false sense of financial security. |

| Compounding Interest | The ongoing accrual of interest on credit card balances, which can quickly escalate the overall debt burden. |

| Minimum Payments | The slow pace of repayment through minimum payments allows compounding interest to continuously add to the debt, trapping individuals in a cycle of growing debt. |

Developing a Debt Repayment Plan

Making a solid debt repayment plan is vital to managing credit card debt. It means sorting out debts, making a budget, and using money wisely to pay off debts. This way, people can overcome credit card debt and achieve financial balance.

To create a debt repayment plan that fits you, follow these steps:

- Write down all your credit card debts and their interest rates.

- Pay off the debts with the highest interest first. This saves you money in the long run.

- Make a budget that shows your income and expenses. Find ways to cut costs or use that money for debt.

- Decide how much you can pay each month towards your debt repayment plan. Make sure you pay the minimum on all cards.

- Look into debt management strategies like balance transfers or consolidation. They might lower your interest rates and make payments easier.

With a well-planned debt repayment plan, you can slowly reduce your credit card debt. This will lower the interest you pay and help you take back control of your finances.

“Creating a detailed debt repayment plan is the first step to financial freedom. It gives you a clear path to pay off debts and end the cycle of credit card debt.”

Credit Card Debt Solutions: Simple Ways to Regain Financial Control

Dealing with credit card debt can feel overwhelming. But, with the right strategies, you can take back control. It’s all about finding practical solutions that help you make smart choices and focus on paying off your debt.

Budgeting and Expense Tracking

First, you need to understand how you spend your money. Create a detailed budget that tracks your income, expenses, and credit card payments. This way, you can spot where you can save money and use it to pay off your credit card debt.

- Categorize your expenses to see where your money goes.

- Set achievable budget goals and stick to them to avoid unnecessary spending.

- Use budgeting tools or apps to make tracking easier and stay on top of your finances.

Prioritizing Debt Repayment

After you know your financial situation, it’s time to focus on paying off your credit card debt. Start with the cards that have the highest interest rates or balances. Create a plan to pay them off one by one.

- Pay more than the minimum on your credit cards to reduce your debt faster.

- Try to get lower interest rates from your credit card providers.

- Use any extra money, like tax refunds or bonuses, to pay off your highest-priority debts.

By using budgeting tips and a solid debt repayment plan, you can take control of your credit card debt. This will improve your financial health. Remember, staying consistent and disciplined is crucial for long-term financial stability.

| Budgeting Tips | Debt Repayment Strategies |

|---|---|

|

|

Using these credit card debt solutions, you can regain control of your finances. This will help you move towards a more secure financial future.

Debt Consolidation: A Viable Option?

For those with many credit card debts, debt consolidation can help. It simplifies payments, lowers interest rates, and can improve your finances. You can choose from balance transfer credit cards or debt consolidation loans.

Balance Transfer Credit Cards

Balance transfer cards let you merge several debts into one. They often have a low or 0% interest rate for a short time. This can cut down on interest and make paying off debt easier.

But, it’s vital to pay off the balance before the promo ends. The regular rate might be higher than your old cards.

Debt Consolidation Loans

Debt consolidation loans combine multiple debts into one fixed-rate loan. This can save money on interest and simplify payments. But make sure to compare rates, fees, and terms to see if it’s better than your current debts.

| Feature | Balance Transfer Credit Cards | Debt Consolidation Loans |

|---|---|---|

| Interest Rate | Typically, a low or 0% introductory rate | Fixed interest rate, often lower than credit cards |

| Repayment Period | Limited promotional period (e.g., 12-18 months) | Longer repayment term (e.g., 3-5 years) |

| Impact on Credit Score | May temporarily lower due to new account and credit utilization changes | It may temporarily lower due to hard credit checks, but it can improve over time with consistent payments |

Choosing debt consolidation through a balance transfer or a debt consolidation loan depends on your financial situation. Both can ease the burden of multiple debts. But it’s essential to think carefully about the terms before deciding.

Negotiating with Creditors

Talking directly to creditors can be a strong move when dealing with credit card debt. You might get lower interest rates, smaller monthly payments, or even settle what you owe. It takes time and effort, but it can help you get back on track financially.

To negotiate well, you need a clear plan and a willingness to meet in the middle. First, collect all the important details about your debt. This includes the balance, interest rates, and how you’ve been paying. This information will help you make a strong case and show you’re serious about fixing the problem.

- Start by contacting your creditors and sharing your financial situation. Be open and honest about your struggles to pay on time.

- Ask for lower interest rates. This can make your monthly payments smaller and save you money in the long run.

- Look into debt settlement. Sometimes, creditors will accept a payment that’s less than what you owe. This can be a good option if you’re really struggling.

- Make sure any agreements are in writing. This protects you and prevents any misunderstandings later on.

Keep in mind, creditors want to work with people who are serious about paying off their debt. Being empathetic, professional, and open to finding a solution can really help. This way, you’re more likely to get a good outcome.

“Negotiating with creditors can be a daunting task, but it’s often the key to regaining control of your financial future.”

Credit Counseling: Professional Guidance

For those struggling with credit card debt, credit counseling services are a big help. These agencies offer debt management plans and more. They help you understand your finances and find ways to take back control.

Understanding Debt Management Plans

A debt management plan helps you pay off credit card debt. Credit counselors talk to your creditors for you. They might get you lower interest rates and no fees.

You make one monthly payment to the agency. They then split it among your creditors.

- Reduced interest rates and fees

- Consolidated monthly payments

- Personalized debt repayment strategies

- Improved credit score over time

Joining a debt management plan makes paying off debt easier. It helps you avoid extra fees and penalties. It’s a step towards financial stability.

“Working with a credit counseling agency helped me better understand my financial situation and develop a realistic plan to pay off my credit card debt.”

| Benefit | Description |

|---|---|

| Debt Consolidation | Debt management plans consolidate multiple credit card balances into a single monthly payment, often at a lower interest rate. |

| Improved Credit Score | As consumers make timely payments through the debt management plan, their credit score can gradually improve over time. |

| Professional Guidance | Credit counselors provide personalized advice and support to help consumers navigate the debt repayment process. |

Debt Settlement: A Last Resort?

When dealing with huge debt settlement or debt relief problems, some turn to debt settlement. It’s about talking to creditors to lower what you owe. But, it can hurt your credit score a lot. It’s important to know the risks and long-term effects before choosing this path.

Debt settlement might cut down what you owe to creditors. This is good for those who can’t pay the minimum and fear defaulting. Yet, it can really hurt your credit score. This makes it tough to get loans, credit cards, or even rent a place later on.

- Debt settlement can negatively impact credit scores, making it harder to obtain credit in the future.

- The process of debt settlement may involve legal consequences, including potential lawsuits from creditors.

- Debt settlement should only be considered as a last resort, after exploring other debt relief options such as debt consolidation or credit counseling.

Think carefully about the pros and cons of debt settlement. Talking to a financial advisor or credit counselor is a good idea. They can help you see the full picture and find better options for your situation.

“Debt settlement should be approached with caution and only after exhausting all other options for debt relief.”

Debt settlement should be a last choice, for those with the worst financial problems. Knowing the risks and getting advice can help you make a choice that’s right for your future.

The Impact of Bankruptcy

When you’re drowning in credit card debt, bankruptcy might be your only hope. It can offer relief, but it’s important to know the long-term effects. Bankruptcy can hurt your credit score, making it hard to get loans, mortgages, or even rent a place.

Bankruptcy stays on your credit report for up to 10 years. This can limit your credit access and make it tough to improve your financial situation. It can also affect your job prospects, as some employers might see it as a negative.

But, bankruptcy can also give you a second chance. It can wipe out eligible debts, helping you take control of your finances. You can start rebuilding your credit by making a budget, paying off debts, and managing your spending.

Before choosing bankruptcy, think about the good and bad sides. Talking to a financial advisor or credit counselor can help. They can guide you to make a choice that fits your long-term financial plans.

| Pros of Bankruptcy | Cons of Bankruptcy |

|---|---|

|

|

Choosing bankruptcy is a big decision. It’s a complex process that needs careful thought and understanding of its long-term effects.

Conclusion

In this guide, you’ve learned many ways to manage credit card debt. Understanding how debt works and making a plan can help you escape high interest rates. Looking into debt consolidation and talking to creditors can also help.

For extra help, consider credit counseling services and debt management plans. Bankruptcy should be a last choice, but knowing its effects is key. Tackling debt needs discipline, but the right steps can lead to financial stability.

Now, you have the tools to improve your financial future. Focus on paying off debt, budget wisely, and find good solutions. This will help you take back control of your money. Use this chance to gain financial freedom and look forward to a better future.