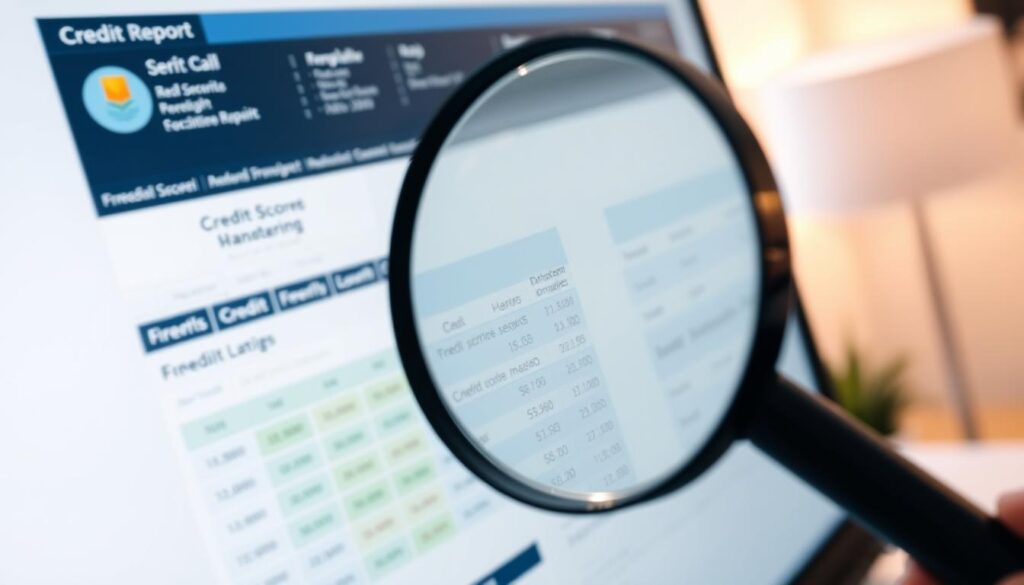

Have you ever thought about how safe your money is today? Identity theft and fraud are getting worse. That’s why keeping an eye on your credit is key.

Good credit monitoring is like a shield for your money. It watches your credit report for any odd changes. This service is very important for keeping your money safe.

Key Takeaways

- Credit monitoring is essential for maintaining financial security.

- It alerts you to any changes in your credit report.

- Reliable credit monitoring helps protect your credit from fraud.

- Monitoring services can be critical for your financial future.

- Being proactive with credit monitoring can save you from financial trouble.

Understanding Credit Monitoring

Credit monitoring is key to keeping your finances healthy. It helps you understand how it can help your financial stability. This service keeps an eye on your credit report. It lets you know about any changes that could affect your credit.

What is Credit Monitoring?

Credit monitoring tracks your credit report for updates, errors, and identity theft signs. Regular credit score monitoring is a big part of this. It lets you see changes in your credit score over time. With these services, you get alerts about:

- New accounts opened in your name

- Late payments recorded on your credit report

- Credit inquiries made by lenders

These alerts help you fix issues fast and keep your financial reputation safe.

How Does Credit Monitoring Work?

Credit monitoring uses automated systems to check your credit report from Experian, TransUnion, and Equifax. When your credit report changes, you get a notification. This alerts you to important news. Key features include:

| Feature | Description |

|---|---|

| Real-Time Alerts | Get instant notifications for any significant changes in your credit report. |

| Credit Report Access | Get periodic access to your credit report to review for accuracy. |

| Identity Theft Protection | Monitor for signs of unauthorized use of your personal information. |

Using these services helps you control your credit health better. You can take steps to improve your credit score.

Benefits of Reliable Credit Monitoring

Using credit monitoring services has many good points. It helps keep your money safe. You get alerts right away when your credit report changes. This lets you fix problems fast.

Adding this to your money routine helps protect you. It keeps your finances healthy.

Real-Time Alerts for Credit Changes

Real-time alerts tell you right away about credit changes. This includes new accounts or late payments. You can check and fix any odd activity fast.

These alerts are key for managing your credit well. They show the value of credit monitoring in today’s fast money world.

Identity Theft Protection

Keeping your identity safe is a big part of credit monitoring. It helps spot and stop bad activity with your info. Alerts early to catch problems before they get worse.

Many services also help fix your identity if it’s stolen. This gives you peace of mind. You know you’re doing everything you can to keep your money safe.

| Feature | Description | Benefit |

|---|---|---|

| Real-Time Alerts | Instant notifications upon changes to your credit report | Stay informed about possible fraud or mistakes |

| Identity Theft Insurance | Covers money lost because of identity theft | Protects your money if someone steals your identity |

| Credit Score Tracking | Keeps an eye on your credit score over time | Helps you see what affects your credit health |

| Identity Recovery Services | Helps you get your identity back if it’s stolen | Guides and supports you during the recovery process |

Choosing the Best Credit Monitoring Services

When picking credit monitoring services, knowing what matters is key. The right choice helps you manage your money and protect your credit. Think about these points when looking at different options.

Top Features to Look For

Focus on important features to find good credit monitoring. Here are key things to look for:

- Regular Updates: Pick a service that updates you often about your credit report.

- Access to Credit Scores: Choose services that let you see your credit score and report easily.

- User-Friendly Interfaces: Look for services that are easy to use, with good apps and navigation.

- Identity Theft Insurance: Some top services offer insurance against fraud, giving you peace of mind.

Comparing Credit Monitoring Companies

When comparing companies, a side-by-side look helps. Here’s what to focus on:

| Company Name | Monthly Fee | Credit Score Access | Identity Theft Insurance | Customer Ratings |

|---|---|---|---|---|

| Experian | $24.99 | Yes | Up to $1 million | 4.5/5 |

| Credit Karma | Free | Yes | No | 4.7/5 |

| IdentityGuard | $19.99 | Yes | Up to $1 million | 4.0/5 |

Free Credit Monitoring Options

Free credit monitoring is a good choice if you’re watching your budget. These services might not have all the features, but they can help. Here are some free options:

- Credit Karma: Gives you free credit scores and reports, plus advice.

- AnnualCreditReport.com: Let’s you see your credit reports for free once a year from each bureau.

- Mint: Tracks your credit score and alerts you to big changes.

Conclusion

Staying informed about your credit is key for a healthy financial future. Credit monitoring is very important. It alerts you to identity theft and shows you your financial health.

Using credit monitoring helps you feel secure about your money. It keeps you safe from surprises and helps you reach your money goals. Knowing your credit status can really change your life.

Using a good credit monitoring service has big benefits. It helps you manage your credit well. Make it a part of your money management to protect your future.